How To Withdraw From Opay Fixed Deposit Account (Complete Guide)

Opay fixed deposit withdrawal

auto ecole senegal

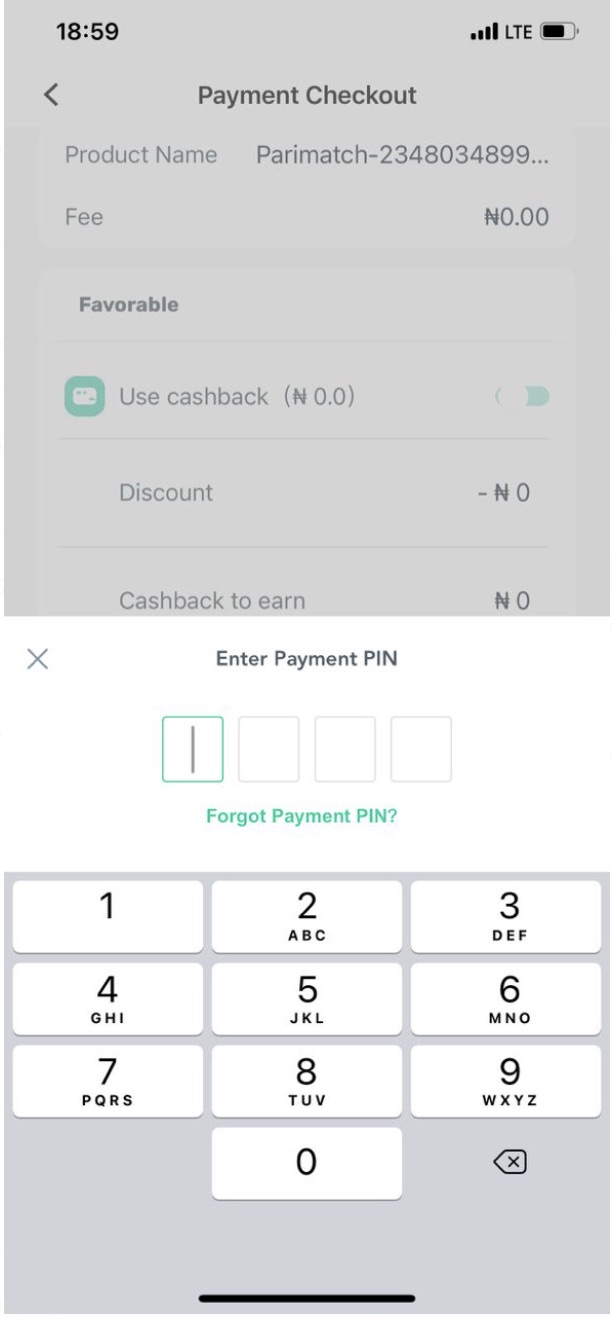

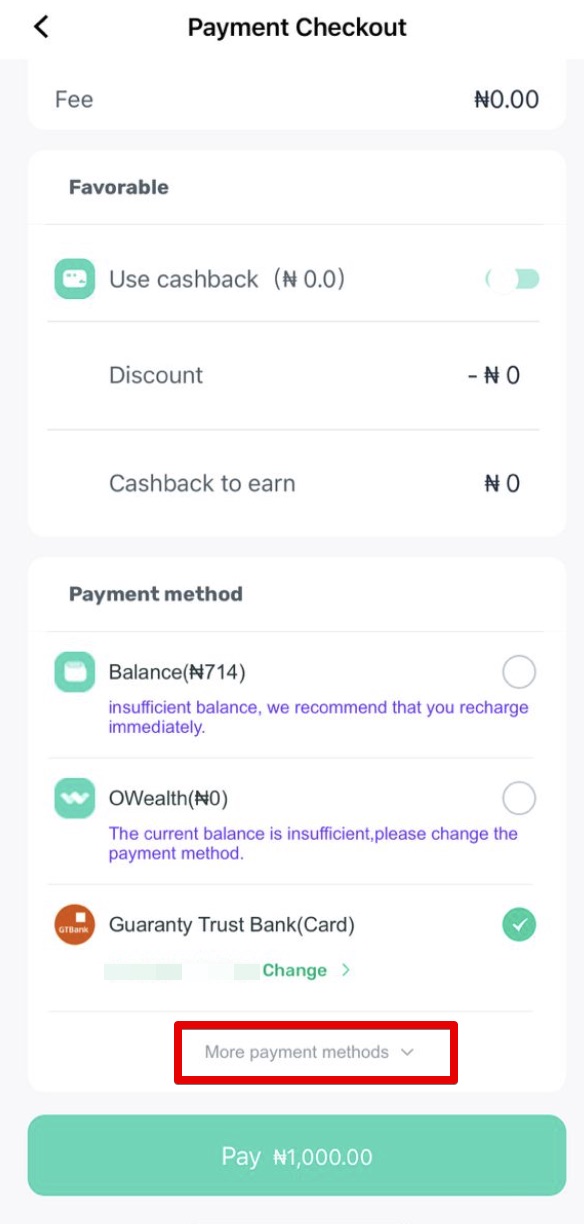

. How can i withdraw from Opay fixed deposit? If you didnt choose to lock your savings while creating the plan, follow the below guide to withdraw it opay fixed deposit withdrawal. 1. Open your Opay application and Navigate to the finance > Savings page 2 opay fixed deposit withdrawal. Click on " fixed " and proceed to the fixed deposit screen 3. opay fixed deposit withdrawal. Owealth, fixed, target: opay savings review, interest rates . - DxMetrics. you can withdraw the money on your Owealth account at any time without any penalty, and can also use it for bill payments, airtime purchases and more. how to deposit on Owealth: Open your opay wallet application on the footer navigation, click on finance Click on Owealth Click on invest Enter the amount you want to invest and confirm. OPay | We are Beyond Banking. 01 888329 (POS Business queries) OPay gives you the freedom to get more opay fixed deposit withdrawal. Our solutions make payments easier, transfers free, savings more rewarding and gives you cashback on airtime and data top-ups. With 100% network uptime, you can make payments in seconds without transaction failure. Enjoy a better life with OPay.. Service Catalog | We are Beyond Banking. 1. Deposit, Withdraw, Transfer Provide users with deposit, withdrawal, and transfer services based on three means-- OPay App, card and USSD. 2. Utility Bill Payment Service Provide users with online utility bill payment services anytime and anywhere (including phone bills, data bills, gaming, electricity bills, TV bills, etc.). 3. Opay Card. Opay Products And Services, Opay Fees, Opay Registration Process, Opay .. Take for instance, mobile money transfers on OPay are free, while withdrawals from ATMs incur a fee of 60 naira per withdrawal opay fixed deposit withdrawal. Read: Owealth, fixed, target: opay savings review, interest rates, FAQs and more Fees for other services such as OBus and OFood are dependent on the distance or the value of the order.. Fixed, Owealth, Target, Spend & Save: What is Opay Savings?, Interest . opay fixed deposit withdrawal. Yes, you can withdraw the savings on your Owealth plan at any time without any penalty or fee. You can also spend the money on owealth without even withdrawing it to your normal opay account. opay fixed deposit withdrawal. How To Withdraw Money From Opay Safebox Account (Complete Guide). Step 4: Click on "Withdraw". Step 5: Enter the withdrawal amount, youll be shown the breaking fee, click on "Next" opay fixed deposit withdrawal. Step 6: Confirm your withdrawal, input your Opay transaction pin and click on withdraw opay fixed deposit withdrawal. Step 7: Your Withdrawal will be processed and the money will be paid to your Opay balance within 24 hours.. OWealth - Savings and Investment Plan by OPay - NaijaTechGuide. You can go the full year or more and you can withdraw your money at any time. Investors will find this article very useful as we break down into details all you need to know about OWealth (An investment scheme by OPay). OWealth currently offers 15% per annum for the first ₦100,000 and 5% per annum for the remainder of your balance.. Opay: Save Money On Everyday Purchases - SpentApp. Spend has been integrated into OPay by Blue Ridge Micro-finance bank to provide savings products. OWealth offers a 15% annual return on investment. New users of Fixed will have an exclusive 20% interest rate for the duration of their fixed term. You can choose from a number of saving options, including your own saving target.. OPay Merchants | We are Beyond Banking. Deposit / Withdraw. Become a bank for your neighbourhood. OPay empowers you to offer deposit and withdrawal services to all customers. We give you all the tools you need to succeed opay fixed deposit withdrawal. Free POS for your business. Reduce the burden of your customer visiting the bank to get cash. Become the available stop for fast cash in your area with a device .. Opay Investment Review | InvestSmall opay fixed deposit withdrawal. How Much Interest Do I Earn with Owealth? With the Owealth package, you receive 15% yearly interest for savings of N100,000 and below opay fixed deposit withdrawal. As for savings you make above N100,000, youll receive 15% yearly interest for the first N100,000 savings and earn 5% interest for the rest of the savings.. Most recommended CD providers of November 2023 - MarketWatch opay fixed deposit withdrawal. While funds like the SPDR® S&P 500 ETF Trust, or SPY, had a loss last year of 18.17%, it has delivered a 5-year gain of 11.70% and 10-year return of 11.47%, as of Nov. 6, 2023, according to .. Kuda vs Opay: which is better? Fees, user feedback . - DxMetrics. You earn an annual interest rate of up to 15% on flexible savings with daily interest and unrestricted withdrawals; Opay customer service is available 24 hours a day, seven days a week. Both offers annual percentage rate of UpTo 10% on fixed deposit of funds; Both apps gives access to credit, with varying interest rates; kuda pros and cons .. OPay how to guide, everything you need to know about opay - Supertechcity opay fixed deposit withdrawal. OPay transfer charges. For withdrawals below ₦20,000, OPay charges 0.5% of the transaction amount. For withdrawal above ₦20,000, OPay charges a flat rate of ₦100

leacuri batranesti pentru hernie disc

. Apart from knowing … Read more. Valley Bank CD Rates of November 2023 - USA TODAY opay fixed deposit withdrawal. And while only two are available online, their minimum opening deposit is relatively low, at $500, and the rates are competitive — offering APYs of 4.75% and 5.25% on fixed six and 12-month terms.. Free Login Forum: OPAY FIXED DEPOSIT WITHDRAWAL. source: opay fixed deposit withdrawal Gain free access and gain more knowledge about "OPAY FIXED DEPOSIT WITHDRAWAL" , Join the discussion below opay fixed deposit withdrawal. Share On Facebook opay fixed deposit withdrawal

البيك الطائف

. FD Premature Withdrawal Penalty Calculator 2023 - Paybima Blogs. Let us take a look at the FD premature withdrawal penalty calculator 2023 for better understanding. As the name suggests, the Fixed Deposit or FD Premature Withdrawal Penalty Calculator is basically used to evaluate the penalty that is imposed on an FD investor if the person withdraws the FD account prematurely.. What happens if you break FD before maturity? (2023) - Investguiding. Most banks charge a penalty of around 1-2 % on premature withdrawal of fixed deposits opay fixed deposit withdrawal. But if a customer has to withdraw before the actual maturity date, the bank may waive off the penalty. For example, SBI levies a penalty of 1% below the rate applicable for the period of time the deposit remains with the bank.. Mobile payment - pay with your phone | OP. Quick and easy. You only need a smartphone or smartwatch to pay for your purchases - you dont need to dig up OPs credentials or payment card details opay fixed deposit withdrawal. When transferring money by using a phone number, money moves at best from one account to another in real time opay fixed deposit withdrawal. You can use the phones contactless payment at a store checkout to also pay .. Premature Withdrawal of Fixed Deposit- Kuvera. Premature Fixed Deposit Withdrawal Penalty Most banks impose charges for early withdrawal of fixed deposits. Typically, this is between 0.5% and 1.0% of the interest rate. In the event of an emergency or if you prefer to invest the same amount in another investment option offered by the bank, some banks do not levy a penalty. opay fixed deposit withdrawal. Premature Withdrawal of Fixed Deposit: SBI, ICICI, HDFC, Kotak. What is Premature Withdrawal. Fixed deposits , with a premature withdrawal facility, allow the depositor to close the FD before the date of maturity arrives. This comes as a relief in times of cash crunch. However, a certain amount may be required to be paid by the depositor as a penalty to the bank. This usually ranges between 0.5% and 1%.. Everything You Need to Know About Fixed Deposits - RinggitPlus. 6-Month Fixed Deposit. Interest Rate at 3.65% p.a opay fixed deposit withdrawal. Deposit Amount (RM) 6-month Interest Profit (RM) 90.43. For a longer placement period of more than 1 year, you will have the option to collect your interest earnings either annually or monthly opay fixed deposit withdrawal. In Malaysia, the longest placement period you can choose is 5 years.. Premature Fixed Deposit Withdrawal: What is the Procedure? - INDmoney. You can opt for FD withdrawal if you need funds urgently. However, you have to pay a penalty ranging from 0.50% to 2% opay fixed deposit withdrawal. When you opt for premature fixed deposit withdrawal, the money is moved to your saving account. The process for premature withdrawal of a fixed deposit online and offline is given below: opay fixed deposit withdrawal. Opay Flexifixed - Make 14% on One Investment! - Bank Naija. Features of Opay FlexiFixed (OPay Investment) OPay FlexiFixed is a new product that works like a fixed deposit yet very flexible opay fixed deposit withdrawal. There are only 3 tenors: 7days, 15days, and 30days

wijnland fertility

. 6.14% p.a.. Monthly Interest Payout on Fixed Deposit - AU Small Finance Bank opay fixed deposit withdrawal. What is a Fixed Deposit (FD)? FDs require you to invest a lump sum amount for any tenure of your choice at a fixed interest rate. We at AU Small Finance Bank offer high FD interest rates wherein the interest payout would vary depending on the tenure, amount invested, and payout option. There are two ways to get a payout.. Withdrawal Slip: Know What is Cash Withrawal Slip & How to Fill it

κάννες βραβεία

. Here is how to fill a withdrawal slip: Fill in the date and the account number from which you wish to withdraw the funds. Fill in the branch information. Mention the details of the payee. Add the amount that you wish to withdraw in numericals, as well as words. Sign the withdrawal slip and mention the name of the account holder.. Can you withdraw your Fixed Deposit prematurely? - Finology opay fixed deposit withdrawal. Procedure for Premature Withdrawal of Fixed Deposit. Generally, the penalty charges range from 0.5% or 1% of the interest rate, based on the value of the FD being up to ₹5 lakh or more. The penalty is the amount charged by the bank when the depositor takes out the money from the bank before the date of maturity.. Fixed Deposit | Open FD Online with Highest Interest Rates | Kotak. The depositor needs to open a fixed deposit account with at least a minimum amount for Fixed Deposit, which is Rs. 5,000 for Kotak Mahindra Bank. The amount remains fixed for a pre-determined time period against the promise of a specific interest rate. There are multiple interest withdrawal options for a fixed deposit.. Features, Benefits, Eligibility Criteria for Fixed Deposit - Paytm. The following are some of the advantages of a fixed deposit: 1. Safe Investment Option. Fixed deposits (FDs) are considered to be one of the safest investment options, as they offer a fixed rate of interest that is not affected by market conditions. This makes them a reliable and stable investment option opay fixed deposit withdrawal. 2. opay fixed deposit withdrawal. Investing Money? Top Factors to Consider Before Investing in a Fixed . opay fixed deposit withdrawal. All the same, you should consider a range of factors before putting your money in one. These factors include inflation, interest rate, FD tenure, premature withdrawal, interest pay-out options, and tax deduction opay fixed deposit withdrawal. In India, putting money in a fixed deposit (FD) is like heeding a piece of wisdom passed down through the generations.. What is FD - Full Form, Meaning, Benefits & Types in India - ET Money opay fixed deposit withdrawal. A fixed deposit or an FD is an investment instrument that banks and non-banking financial companies (NBFC) offer their customers. Through an FD, people invest a certain sum of money for a fixed period at a predetermined rate of interest in an FD. The rate of interest varies from one financial institution to another, although it is usually .. FIXED DEPOSIT / RECURRING DEPOSIT PAYIN SLIP (FD/RD) - HDFC Bank. depending upon the period of deposits opay fixed deposit withdrawal. In case of Monthly Deposit Scheme, the interest will be calculated for the quarter and p aid monthly at discounted value. In Case of premature withdrawal of the fixed deposit based on d epositors instructions or the insuctions of all the joint depo sitors in the case of joint deposit, opay fixed deposit withdrawal. Premature FD Withdrawals: How to Withdraw and Penalty Rates?. Penalty for premature withdrawal of an FD. 1% on the rate throughout the duration of the FDs stay with the bank. The final interest rate applicable. 6% p.a. (7% - 1%) The final effective annual interest rate applicable opay fixed deposit withdrawal. 6.14% p.a. Premature withdrawal amount. ₹10,61,364. The above is the most generally used technique for calculating the . opay fixed deposit withdrawal. Fixed Deposit Withdrawal Application - A Comprehensive Guide 2023. 2. Through the Process of Bank Branch Visit: Go to a nearest branch of your bank. Get the closure form from the bank and fill it opay fixed deposit withdrawal. Also fill the application for withdrawal of FD. Submit FD bond and any other paper that is required. The bank will verify all the details and will deposit the money in your account.. Know the rules for premature withdrawal of fixed deposits

pasos o abras

. For deposits above ₹ 5 crore, it charges 1.5% penalty if the account is closed after five years and 1% penalty if there is premature withdrawal in less than five years. opay fixed deposit withdrawal. Monthly Interest Payout Fixed Deposit (FD) - Groww. Here is the procedure mentioned below that would help you calculate your monthly interest payout through the calculator: Step 1: You need to go to the official portal of the bank. Step 2: Navigate to the option that leads to the Fixed Deposit Calculator page. Step 3: Enter the amount of deposit and select the type of customer, the type of FD .. TDS on Fixed Deposit Schemes - How to Save on Income Tax - Paisabazaar.com. The tax on fixed deposit interest income is calculated for an individual and the tax they are charged depends on the slab rate under which they fall. This can be explained through an example. If you wish to invest Rs. 300,000 in fixed deposits which give an interest of 10%, the interest earned will be Rs. 30,000 and the TDS deducted is Rs. 3,000.. Premature Withdrawal of Fixed Deposits: Why You Should opay fixed deposit withdrawal. - PersonalFN opay fixed deposit withdrawal. 7.5% p.a. Penalty for premature withdrawal of an FD. 1% on the lower of the interest rates at which the FD was booked and the interest rate for the period that the FD has been held in the bank opay fixed deposit withdrawal. The final interest rate applicable. 6% p.a opay fixed deposit withdrawal. (7% - 1%) Premature withdrawal amount. Rs 5,30,682.. Fixed Deposit Premature Withdrawal and the Impact on Interest Calculation opay fixed deposit withdrawal. Interest Rate on 6-month FD at time of Booking. 6.25%. Penalty charges due to Premature Withdrawal opay fixed deposit withdrawal. 0.50%

o2tvseries romance movies

. Palmpay vs Opay fees. Both palmpay and opay offer free transfer on their application. for palmpay, the first three transfers for the day are free and N10 is charged for subsequent transfers to other banks and 0.9% to other mobile money platforms. Transfers on opay application are free, you dont pay any fee.. Monthly Payout FD Calculator - How Much You Can Get Monthly From Fixed . opay fixed deposit withdrawal. In case if there is requirement of loan you can take benefit from your FD to avail a loan avail against a fixed deposit. You can get a loan up to 90% of the principal amount invested. Simultaneously, you will earn interest on the fixed deposit and pay interest on the loan opay fixed deposit withdrawal. What Are Drawbacks of Fixed Deposit(FD)?. Download OPay APK (Business) latest v6.2.2.121 for Android. Order Food (OFood): You can order food from your favorite leading restaurants through the OPay app. Deposit/Withdrawal: Find nearby agents to withdraw or cash out opay fixed deposit withdrawal. Fixed Savings: A fixed Savings Plan makes it easier to achieve certain goals or projects because you can save for 7 days and earn up to 18% interest per year with Fixed Savings Plan.. How to Withdraw Money from Fixed Deposit After Maturity?. Follow these simple steps to learn how to withdraw money from a fixed deposit after maturity online. Step 1: Log on to your internet banking portal using your login credentials and go to the fixed deposit tab. Step 2: Search for the option withdraw FD, and just click on it. Step 3: Select the fixed deposit details, and follow the process .. How to Withdraw Money from Fixed Deposit After Maturity?. Step 2: Within the fixed deposit section, locate the option that allows you to withdraw your fixed deposit. It might be labeled as withdraw FD or something similar opay fixed deposit withdrawal. Click on that option. Step 3: After clicking on the withdrawal option, you will be presented with a list of your fixed deposits opay fixed deposit withdrawal. Select the specific fixed deposit from which .. The Complete Guide to Money Market Accounts - Investopedia. The average interest rate for an MMA was 0.59% in May 2023 while the average savings account paid about 0.4%. That money market rate represent an average of the $10,000 and $100,000 product tiers .. Application for Withdrawal of Fixed Deposit - Policybazaar opay fixed deposit withdrawal. Visiting The Branch: Step 1: Visit the banks local branch. Step 2: Fill out the fixed deposit closure form and the application for the fixed deposit withdrawal. Step 3: Submit fixed deposit bond and other required documents. Step 4: After verifying all the details, money will be deposited into your account.. premature-withdrawal-of-fixed-deposit - Bank of Baroda. If an investor withdraws a fixed deposit of less than Rs. 5 lakhs after being held for more than 12 months after the deposit date, there is no penalty in such a case. Bank of Barodas time deposits are of two types: callable and non-callable. Callable FDs are FDs with premature withdrawal facility.

pulovere dama tricotate manual

. FD | fixed deposit: How interest on bank FD is calculated in case of .. Since SBI charges a premature withdrawal penalty of 0.50 per cent on FD amounts of less than Rs 5 lakh, the effective interest rate after deduction of the penalty will be 5.75 per cent (less than the original booked interest rate by 1.25 per cent). The amount to you will be Rs 1,03,213, calculated at 5.75 per cent in case of premature withdrawal.. How to do Premature Withdrawal of Fixed Deposit - DBS Bank. Method 2. Suppose you invest in an FD of Rs 1 lakh for 2 years and at an interest rate of 6%. Now, assume that the rate of interest for 1 year is 7% at the time of booking opay fixed deposit withdrawal. The penalty levied in case of premature withdrawal is 1% of the effective rate of interest, which is the lower of the rates. If you withdraw after the completion of 1 year .. How To Partially Withdraw Funds from Fixed Deposit | HDFC Bank. Banks allow you to withdraw the fixed deposit amount prematurely or upon maturity. However, partial withdrawal before maturity is not allowed if the account is a Tax Saver/Non-Withdrawable Fixed Deposit. Most banks have a lock-in period of five years for a Tax Saver Fixed deposit. Usually, banks charge a penalty for withdrawing any Fixed .. post office time deposit: Post office time deposit premature withdrawal .. Each bank has its own policy related to rules and penalty in case of premature withdrawal of a bank fixed deposit (FD). Usually, banks charge penalty of 0.50% to 1% for premature withdrawals. According to the State Bank of Indias (SBI) website, the bank charges 0.50% for FDs up to Rs 5 lakh and 1% for FDs above Rs 5 lakh. .. Resolution Form Board With Withdrawal Of Fixed Deposit. Here is the step-by-step instruction on how to get the Resolution Form Board With Withdrawal Of Fixed Deposit: Examine the page content attentively to make sure it fulfills your needs. Read the form description or verify it through the Preview option. Locate another sample via the Search bar in the header if the previous one doesnt suit you.. OPay | We are Beyond Banking. 0700 888329 opay fixed deposit withdrawal. OR. 01 888329. (POS Business queries) OPay gives you the freedom to get more. Our solutions make payments easier, transfers free, savings more rewarding and gives you cashback on airtime and data top-ups. With 100% network uptime, you can make payments in seconds without transaction failure. Enjoy a better life with OPay.. Choose Paytm Payments Bank for the best fixed deposit account. From the apps main menu, navigate to and click on the Paytm Bank option. Enter your passcode to access your Paytm Bank account

loto noroc arhiva

. From the Paytm Bank menu, click on the Create FD option. Enter the amount you want to deposit in your fixed deposit account. Click on the Proceed button to complete the process of opening a fixed .. Open FD Online at an Attractive Interest Rate - Axis Bank. Axis Banks Fixed Deposit (FD) is a safe and convenient way to see your savings grow opay fixed deposit withdrawal. Open a Fixed Deposit online with Axis Bank and save a minimum of Rs. 5,000 for a flexible tenure starting from a minimum of 7 days to a maximum of 10 years. Axis Banks online account opening services help you to open a Fixed Deposit account from wherever .

. 3 ways to avoid penalty on premature withdrawal of bank fixed deposit .. SBI charges a penalty of 0.5% for retail term deposit of up to ₹ 5 lakh across tenures. A premature withdrawal of bank fixed deposit will attract some penalty.There are ways to avoid penalty on .. Joint Fixed Deposit Withdrawal Rules: Are there any Tax . - INDmoney. To start a fixed deposit plan, you must deposit a standard FD minimum amount. Typical minimum fixed deposit amounts vary by bank and are usually between ₹1,000 and ₹15,000. So remember to check with the relevant bank to understand their policies regarding minimum joint deposits. Withdrawal policy in Joint Fixed Deposit. opay fixed deposit withdrawal. Premature FD Withdrawal Penalty - How Much You Will Lose? - ICICI .. 2. Disrupted financial growth. FDs offer guaranteed returns to investors. However, a premature withdrawal disturbs the steady cash flow and the depositors overall financial growth. 3. Loss of interest amount. Any withdrawal of the fixed deposit before the maturity date can lead to a reduction in the interest amount..